Debt Collection Made Simple with Credifin: Your Best Selection

Wiki Article

Reliable Strategies for Lending Collection: Recuperate Your Financial obligations

You will certainly discover how to recognize financial obligation recovery strategies, develop better interaction with consumers, carry out a structured collection procedure, make use of modern technology for effective financial obligation monitoring, as well as navigate lawful considerations. With these workable suggestions, you can take control of your car loan collection procedure as well as successfully recover your financial obligations.:max_bytes(150000):strip_icc()/tactics-for-paying-off-debt-collections-960596-final-dd5c75985b904e46b8d1bd8e0a9f4d77.jpg)

Comprehending Financial Debt Recuperation Methods

To efficiently recuperate your financial obligations, you require to comprehend financial obligation recuperation strategies. One important technique is communication.An additional effective financial debt healing strategy is documentation. In addition, it aids you stay organized and also track the progress of your debt collection efforts.

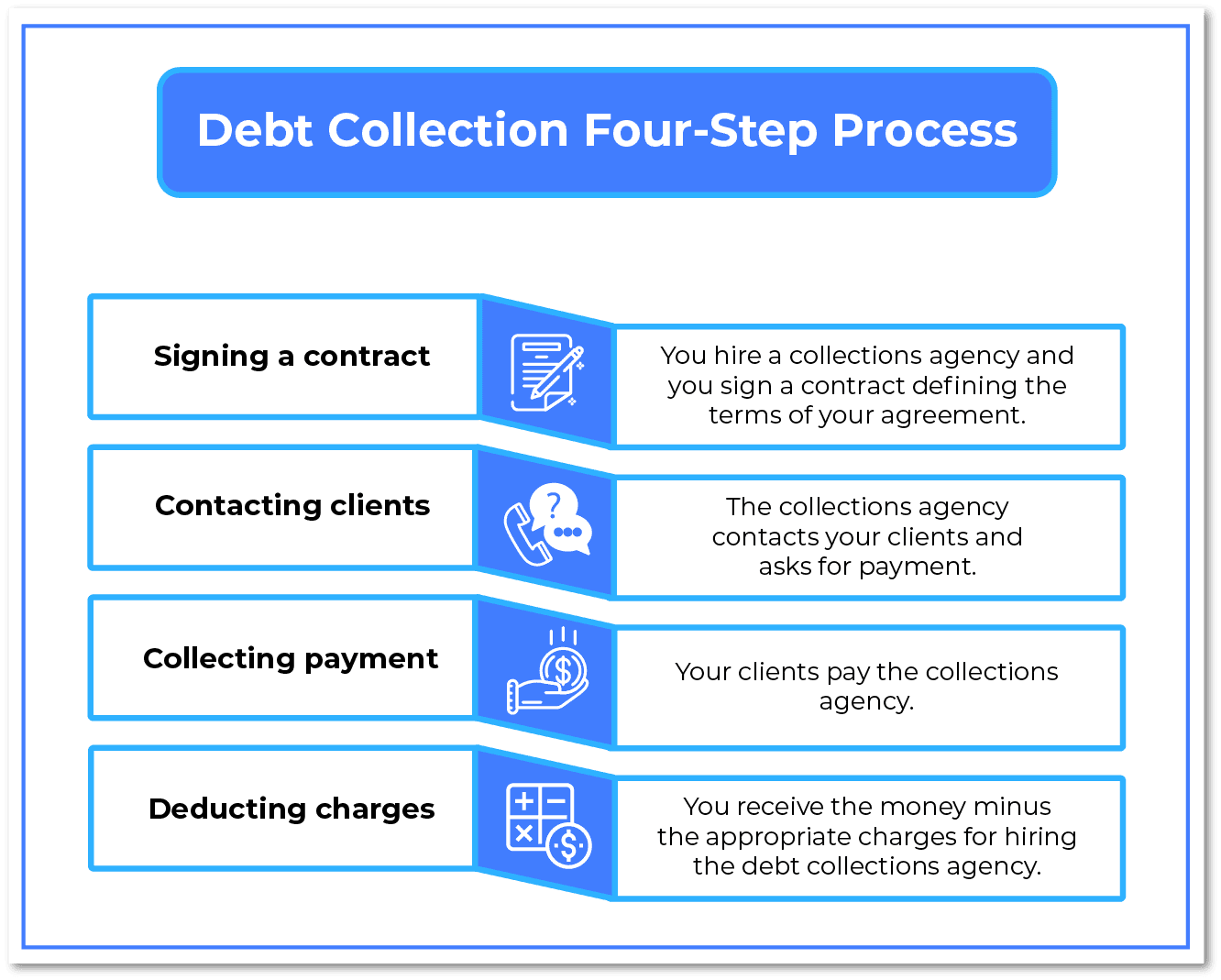

Making use of the services of a debt collection firm can considerably enhance your possibilities of successful financial debt recovery. These agencies have the experience and resources to handle the collection procedure on your behalf. They utilize various approaches, such as avoid mapping as well as credit score reporting, to situate debtors as well as encourage timely payment.

Building Effective Communication With Consumers

Begin by reaching out to your consumers in a specialist and pleasant fashion. Let them recognize that you are mindful of their exceptional financial debt and that you want to collaborate with them to discover an option. Show compassion and understanding in the direction of their scenario, yet additionally make it clear that you anticipate the financial debt to be repaid.

During your discussions, be certain to proactively pay attention to what your debtors need to state. Ask flexible concerns to encourage them to share their issues as well as challenges - credifin. This will certainly aid you get a much better understanding of their financial scenario and also allow you ahead up with a suitable payment plan

Maintain regular call with your borrowers throughout the financial debt recuperation procedure. This will certainly help them really feel supported and also will likewise work as a tip of their responsibility to pay back the financial debt. By remaining in touch, you can deal with any kind of concerns or problems that might develop and also keep the lines of communication open.

Implementing a Structured Collection Process

By carrying out a structured collection procedure, you can improve the financial obligation recovery procedure as well as enhance your opportunities of obtaining back what is owed to you. Having an organized technique indicates having a clear plan in place to take care of financial obligation collection. When dealing with debtors who have superior financial debts, this entails setting up particular actions and also treatments to adhere to.It is important to establish a timeline for financial debt collection. This timeline needs to outline the particular activities that need to be taken at various stages of the procedure, such as sending tips, releasing cautions, and even taking lawful activity if essential. By having a clear timeline, you can ensure that you are constantly as well as proactively seeking the recovery of the financial debt.

Secondly, executing an organized collection process implies having a methodical technique to documentation and also record-keeping. This consists of keeping accurate records of all communications with debtors, along with any kind of agreements or promises made regarding settlement. Having these documents easily offered can aid you track the progress of each instance and offer proof if lawsuit ends up being essential.

Finally, an organized collection process involves routine surveillance as well as assessment. This suggests consistently evaluating and also assessing the effectiveness of your collection initiatives. By determining any type of areas of enhancement or patterns in borrower behavior, you can make needed adjustments to your strategies as well as boost your opportunities of effective financial obligation recovery.

Making Use Of Technology for Effective Financial Debt Management

Utilizing innovation can significantly enhance the efficiency of handling your financial debt. With the improvements in modern technology, there are now a variety of resources as well as tools offered to aid you enhance your financial obligation you can look here administration procedure. One of the most reliable ways to utilize innovation is by using debt management software application.Legal Factors To Consider in Financing Collection

When it comes to recovering your financial debts, it is essential to recognize the lawful facets entailed. It's likewise vital to familiarize yourself with the Fair Financial Debt Collection Practices Act (FDCPA), which sets standards on exactly how that site debt collectors can interact with borrowers. By recognizing and also complying with the lawful factors to consider in finance collection, you can make sure that you are running within the borders of the law while maximizing your possibilities of recuperating the financial debts owed to you.Verdict

In verdict, by implementing reliable approaches for financing collection, you can efficiently recover your debts. By complying with these approaches, you can enhance your possibilities of efficiently recuperating the financial debts owed to you.You will find out how to comprehend debt healing techniques, build much better communication with debtors, carry out an organized collection process, use modern technology for reliable financial debt monitoring, and also navigate lawful considerations. To properly recuperate your debts, you need to recognize debt healing methods. Using the solutions of a debt collection company can significantly boost your opportunities of successful financial debt recuperation. It's additionally vital to acquaint yourself with the Fair Financial Obligation Collection Practices Act (FDCPA), which sets special info standards on just how financial obligation collection agencies can connect with borrowers. By recognizing as well as following the lawful considerations in finance collection, you can ensure that you are running within the boundaries of the legislation while maximizing your opportunities of recovering the debts owed to you.

Report this wiki page